Sign up for our newsletter!

Your data will be handled in compliance with our privacy policy.

Your data will be handled in compliance with our privacy policy.

Håkan Persson, CEO of Smoltek, talked at the one-day conference Aktiedagen Lund organized by Aktiespararna (the Swedish Shareholders’ Association). His presentation offered some news and insights that are worth exploring further. So, let’s follow up with some questions for Håkan.

Thomas Barregren • October 20, 2023

At the beginning of October 2023, Smoltek’s CEO, Håkan Persson, talked at the one-day conference Aktiedagen Lund organized by the Swedish Shareholders’ Association. Some of what he said is probably known to you as a well-informed shareholder or investor, but there are also some insights, if not news, worth noting.

So, I sat down with Håkan to follow up on some points he made in his presentation. In total, we covered seven topics in depth. You can read the questions and answers in this post.

But before doing that, you may want to check out his presentation.

In your talk, you say that Smoltek has explored many application areas for its patent-protected technology – growing carbon nanofibers on different materials. Among all these, Smoltek has focused on decoupling capacitors and electrolyzer cell materials. Why?

We have a long list of possible applications for our technology. It ranges from heat dissipation to biosensors. Many items on the list are related to semiconductors. This is because Smoltek has grown out of research in this area at Chalmers University of Technology. But there is also a lot on the list that is not related to the semiconductor industry.

To explore the opportunities outside the semiconductor industry, we formed a separate business division, Smoltek Innovation, to identify an imminent need that we can address. Our analysis showed that the global hydrogen market urgently needs a better electrolyzer cell material where we can make a big difference. So, we decided to focus on that market, and consequently, we changed the name of the business division to Smoltek Hydrogen.

Even before that, we had formed a separate business division, Smoltek Semi, to do the same for the semiconductor industry. We found that metal-insulator-metal (MIM) capacitors, used by the semiconductor industry, are a huge market where we can make a big impact.

That’s why we are pursuing these two markets with carbon nanofiber-enhanced cell material and carbon nanofiber-enhanced MIM capacitors, respectively.

We are focusing exclusively on these two business divisions for now and in the foreseeable future. But we have many more ideas on our list, so we expect to create more business divisions in the future. You can think of Smoltek as an incubator for carbon nanofiber-reinforced solutions for various applications.

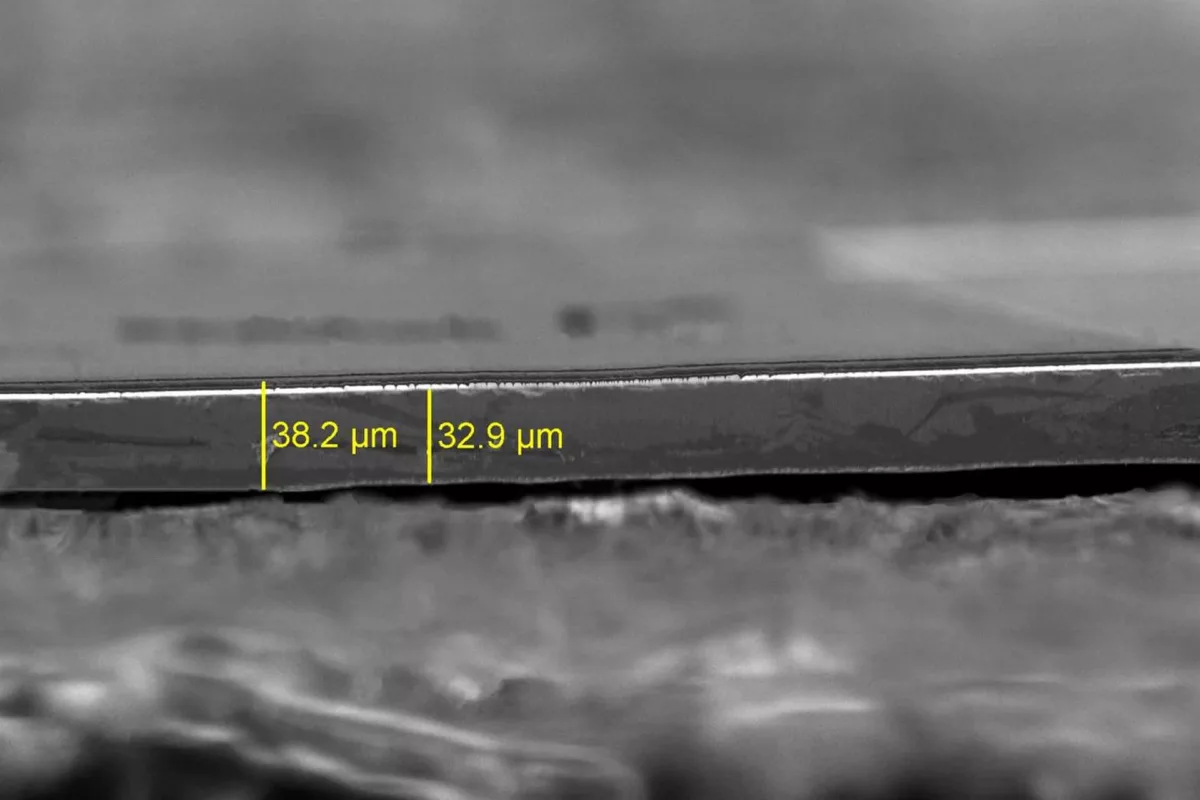

In 2021, Smoltek presented the world’s thinnest capacitor as a fully usable prototype. In your presentation, you say Smoltek can manufacture ultra-thin decoupling capacitors more efficiently than competing technologies. Does this mean that competitors have caught up?

No, there are currently no thinner capacitors on the open market than our prototype.

But there are strong contenders whose capacitors can also be characterized as ultra-thin. These capacitors are manufactured by digging deep trenches in silicon. This is why they are called deep trenches capacitors or silicon capacitors. They are not widely used because of their costs, and we believe there is a limit to how far they can go.

We don’t feel competitors breathing down our neck because our CNF-MIM capacitors have two competitive advantages over silicon capacitors.

First, CNF-MIM capacitors are expected to be cheaper to produce, so we can compete on price and still have a good margin for capacitors aimed at high-end device segments.

Second, our capacitors will have significantly higher capacitance per unit area and unit height.

You mentioned that Smoltek targets the premium segment, except Apple, with its CNF-MIM capacitors. Can you explain that strategy?

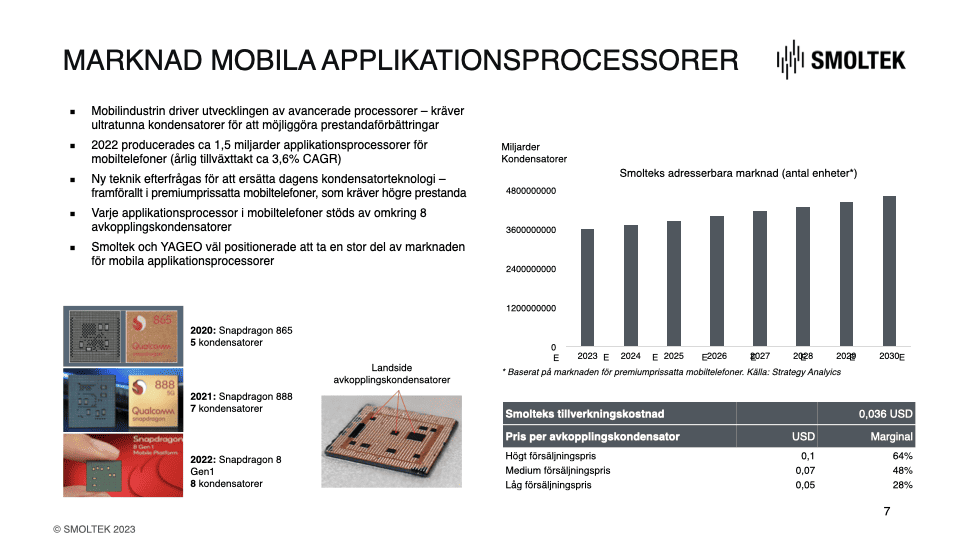

I talked about the premium segment of the smartphone market. We define the segment as smartphones that 2023 cost more than 300 USD to buy from wholesalers.

There are hundreds of brands in this market segment. The largest is Samsung. The best-known is Apple. But there are also other big players like Xiaomi, Oppo, and Vivo, as well as well-recognized brands such as Google Pixel and Sony Xperia.

It is this market segment that we address with our CNF-MIM capacitors. With one crucial exception: Apple.

Of course, Apple knows what we are doing. But right now, we choose to focus on the rest of the premium segment because we believe Apple has a tight partnership with a capacitor manufacturer and is not likely to jump ship any time soon.

Although Apple represents one-third of the premium segment, the remaining market is huge. We estimate that the other premium smartphone manufacturers purchase between 3.5 and 4.5 billion capacitors annually. And our goal is to capture one-third of that market eventually.

We are considering making smartphones our first target market because they greatly need ultra-thin capacitors. And we narrowed it down to the premium segment because of the higher gross profit margin.

However, the market for CNF-MIM does not end with smartphones. We are exploring other possibilities and have identified more places where our capacitor technology can make a big difference. So, the mobile market is just the beginning.

You say that Smoltek and YAGEO have started planning for the next step. What does that mean?

Let me start by recapitulating where we are today and where we are going.

YAGEO wants the right to sell our CNF-MIM capacitors when that time comes. And we need a distributor who can sell and ship our capacitors to the big players. We have therefore agreed on a collaboration with two phases.

The first phase is to develop and produce engineering samples of CNF-MIM capacitors and bring them to the market. This allows potential customers to test and design them into their applications. This phase is governed by a joint development agreement (JDA) that we signed in August 2022.

The second phase is forming a joint venture to mass-produce our CNF-MIM capacitors. We plan for a fabless production, which means the manufacturing will be done by subcontractors rather than in-house. Production will start when we have a design-win, when someone has designed a future product with our CNF-MIM capacitors.

Right now, we are in the first phase. We have made the first batch of just over a quarter of a million capacitors without carbon nanofibers. We are currently making a similar batch, now with carbon nanofibers. These will be tested and evaluated by YAGEO, and when they meet the performance metrics outlined in the joint development agreement, we will enter phase 2.

In parallel with the development of engineering samples, YAGEO and Smoltek have already begun planning the next step to avoid losing time.

The fact that YAGEO is already prepared to put in the resources and do the work involved in planning for phase two is an excellent testimonial from YAGEO.

Let’s switch gears and talk about the hydrogen industry. Smoltek develops and plans to sell electrolyzer cell material. What is it?

It’s a layer of corrosion-coated carbon nanofibers that penetrates the membrane on the anode side. On the outside of the metal are atoms of iridium.

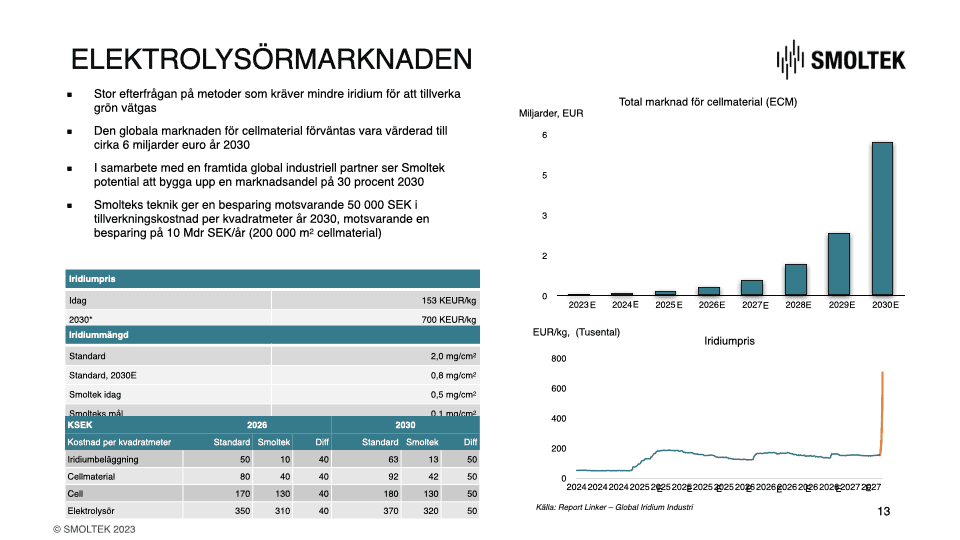

Iridium is a scarce and costly earth metal used as a catalyst in a particular type of electrolyzer. Smoltek’s cell material will use 95 percent less iridium than existing technology, thus conserving a finite resource and saving vast amounts of money for producers of electrolyzers.

This market is massive. It is not just about future energy systems and transportation. There is a huge need here and now. Hydrogen has been used in industry for over 100 years.

But 95 percent of that hydrogen is produced from fossil fuels. That is not sustainable. Therefore, the industry is facing a gigantic transition to electrolyzers that produce fossil-free hydrogen. And that’s when iridium is needed.

Fossil-free hydrogen, or green hydrogen, is produced by running electricity from solar, wind, or hydropower plants through water. This is called water electrolysis. The apparatus in which it takes place is called an electrolyzer.

There are two types of electrolyzers: an older type with low efficiency and uses alkaline chemicals, and a newer type that is more efficient and doesn’t use chemicals. The newer technology uses a proton exchange membrane (abbreviated PEM), and consequently, it is called a PEM electrolyzer.

PEM electrolyzers need iridium as a catalyst. The metal acts as a place for water molecules to hold on while they split into hydrogen and oxygen.

And here is the crux: Iridium costs many times more than gold because it’s so rare and hard to extract. In 2023, a single kilo of iridium costs up to 200,000 euros; by 2030, just seven years from now, it is estimated to cost up to 700,000 euros.

So even though current technology only needs 2 milligrams of iridium per square centimeter of membrane, it is a significant cost for electrolyzer manufacturers.

That’s the problem we address with our cell material.

Smoltek’s cell material currently uses 75 percent less iridium than available technology. And we expect to save up to 95 percent of iridium compared to today’s existing technologies. In this way, our cell material conserves a finite resource and saves a lot of money for electrolyzer manufacturers.

What prevents competitors from making the same savings?

The standard technology uses 2 milligrams of iridium per square centimeter. External research institutes expect this level to be reduced to 0.8 milligrams per square centimeter by 2030.

Improving the current technology beyond this will be difficult, and the technology has a limit where iridium cannot be further reduced without severe deterioration of the lifetime.

Compare that to Smoltek’s cell material, which uses only 0.5 milligrams already, expecting to reach 0.2 milligrams quite soon and eventually 0.1 milligrams.

Our technology is protected by patents and pending patents. And entirely new solutions require years of research and development. Remember, we have been working on carbon nanofibers for almost 20 years.

How will Smoltek bring the cell material to market?

The approach is the same as we use for our capacitors.

We are working in parallel to further develop the cell material from a lab prototype to a verified product and to develop an industrial process for mass production. We expect to step out of the lab and take the first steps in the industrial arena in 2024.

The goal is to be up and running with mass production in 2027. Before that, we will start small-scale production of engineering samples and find the right partners to bring the cell material to the world market.

Seven questions and seven thorough answers later, I conclude by reminding you to visit Smoltek’s investor relations page on LinkedIn. Find the post about this Q&A and tell us what you want to know more about. I can’t promise you’ll get an answer right away or even at all. After all, Smoltek is a listed company and has many rules to consider. But we will do our best to answer everything we can in due course.

Your data will be handled in compliance with our privacy policy.